Top Guidelines Of Feie Calculator

Wiki Article

7 Simple Techniques For Feie Calculator

Table of ContentsWhat Does Feie Calculator Mean?Feie Calculator Can Be Fun For EveryoneWhat Does Feie Calculator Do?The 7-Minute Rule for Feie CalculatorExcitement About Feie Calculator4 Simple Techniques For Feie CalculatorFeie Calculator for Beginners

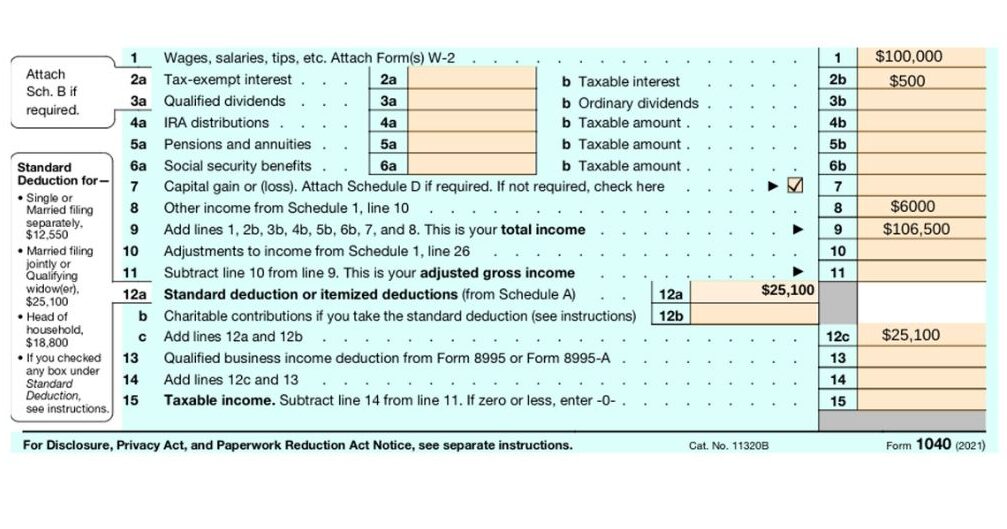

If he 'd frequently taken a trip, he would certainly rather complete Part III, providing the 12-month period he met the Physical Visibility Test and his traveling history. Action 3: Reporting Foreign Income (Part IV): Mark earned 4,500 per month (54,000 yearly).Mark calculates the exchange price (e.g., 1 EUR = 1.10 USD) and converts his wage (54,000 1.10 = $59,400). Because he lived in Germany all year, the percent of time he lived abroad throughout the tax is 100% and he enters $59,400 as his FEIE. Lastly, Mark reports total incomes on his Type 1040 and gets in the FEIE as an adverse amount on Schedule 1, Line 8d, lowering his gross income.

Picking the FEIE when it's not the most effective alternative: The FEIE may not be optimal if you have a high unearned revenue, earn greater than the exclusion limit, or stay in a high-tax country where the Foreign Tax Credit (FTC) might be extra useful. The Foreign Tax Debt (FTC) is a tax obligation decrease strategy typically utilized combined with the FEIE.

The Definitive Guide for Feie Calculator

deportees to counter their U.S. tax obligation financial obligation with foreign income tax obligations paid on a dollar-for-dollar decrease basis. This indicates that in high-tax countries, the FTC can frequently eliminate united state tax debt totally. Nevertheless, the FTC has constraints on qualified taxes and the optimum claim quantity: Eligible taxes: Only revenue tax obligations (or taxes in lieu of revenue taxes) paid to international governments are eligible.tax obligation responsibility on your foreign revenue. If the foreign taxes you paid surpass this limit, the excess international tax obligation can typically be brought forward for approximately 10 years or returned one year (via a changed return). Keeping precise documents of international revenue and tax obligations paid is consequently crucial to calculating the appropriate FTC and preserving tax obligation conformity.

expatriates to reduce their tax obligations. For example, if a united state taxpayer has $250,000 in foreign-earned revenue, they can exclude up to $130,000 using the FEIE (2025 ). The staying $120,000 may then go through taxation, however the united state taxpayer can potentially apply the Foreign Tax obligation Credit score to counter the taxes paid to the foreign nation.

Facts About Feie Calculator Uncovered

First, he sold his U.S. home to develop his intent to live abroad completely and made an application for a Mexican residency visa with his spouse to help fulfill the Authentic Residency Examination. In addition, Neil safeguarded a long-lasting building lease in Mexico, with plans to at some point buy a residential property. "I currently have a six-month lease on a house in Mexico that I can prolong another six months, with the intention to acquire a home down there." Nevertheless, Neil explains that buying building abroad can be testing without initial experiencing the location."It's something that people require to be actually persistent concerning," he says, and suggests expats to be careful of usual mistakes, such as overstaying in the U.S.

Neil is careful to mindful to Tension tax authorities tax obligation "I'm not conducting any performing in Service. The United state is one of the couple of nations that taxes its citizens no matter of where they live, meaning that even if an expat has no income from United state

6 Easy Facts About Feie Calculator Explained

tax returnTax obligation "The Foreign Tax Credit report allows individuals functioning in high-tax nations like the UK to counter their U.S. tax obligation obligation by the amount they've currently paid in tax obligations abroad," claims Lewis.The possibility of lower living costs can be tempting, but it commonly includes trade-offs that aren't promptly noticeable - https://www.brownbook.net/business/54115417/feie-calculator/. Real estate, as an example, can be extra inexpensive in some countries, but this can imply jeopardizing on infrastructure, safety and security, or accessibility to reliable utilities and services. Inexpensive homes may be found in locations with inconsistent internet, minimal public transport, or unstable healthcare facilitiesfactors that can significantly influence your daily life

Below are some of one of the most often asked inquiries regarding the FEIE and other exclusions The Foreign Earned Income Exclusion (FEIE) allows united state taxpayers to omit up to $130,000 of foreign-earned revenue from federal revenue tax, decreasing their united state tax obligation obligation. To get FEIE, you have to satisfy either the Physical Visibility Test (330 days abroad) or the Bona Fide House Examination (prove your main house in an international country for a whole tax year).

The Physical Visibility Examination additionally needs United state taxpayers to have both an international revenue and a foreign tax home.

Feie Calculator - The Facts

An earnings tax obligation treaty in between the U.S. and another nation can aid prevent dual taxation. While the Foreign Earned Revenue Exemption reduces taxable income, a treaty might give added advantages for qualified taxpayers abroad. FBAR (Foreign Bank Account Report) is a required declare united state people with over $10,000 in foreign monetary accounts.

Neil Johnson, CERTIFIED PUBLIC ACCOUNTANT, is a tax obligation consultant on the Harness platform and the founder of The Tax Dude. He has over thirty years of experience and currently focuses on CFO services, equity compensation, copyright taxation, marijuana tax and divorce associated tax/financial planning issues. He is an expat based in Mexico.

The foreign gained earnings exemptions, often referred to as the Sec. 911 exclusions, leave out tax on incomes gained from working abroad.

Fascination About Feie Calculator

The revenue exclusion is currently indexed for inflation. The maximum annual revenue exclusion is $130,000 for 2025. The tax advantage leaves out the earnings from tax at lower article tax obligation prices. Previously, the exclusions "came off the top" reducing earnings based on tax at the top tax prices. The exemptions might or might not lower earnings made use of for other purposes, such as IRA limitations, child credit reports, personal exceptions, and so on.These exclusions do not exempt the earnings from US taxes but simply supply a tax decrease. Note that a bachelor working abroad for all of 2025 that gained concerning $145,000 with no other income will certainly have gross income decreased to absolutely no - successfully the exact same solution as being "tax complimentary." The exemptions are computed every day.

If you participated in organization meetings or seminars in the US while living abroad, income for those days can not be excluded. For US tax it does not matter where you maintain your funds - you are taxable on your worldwide income as a United States individual.

Report this wiki page